He can be considered the best economist of the 20th century and one of the most important in history, I know he is talking about John Maynard Keynes, this work talks about part of his life and his great contributions to economic theory, the starting point of Keynes was that he treated short-term economic fluctuations in broad strokes and the great depression in particular, he believed that this was because the demand and aggregate of goods and services are insufficient. I am interested in unemployment in industrialized countries, economic cycles and his critical contributions to society, and his great influence on public policy.

The present study refers to the economic contributions where economic contributions such as aggregate supply and demand, the liquidity trap, the balance with unemployment, and others will be seen in a general way.

With his return to macroeconomic and monetary problems, crises, and depressions where fiscal policy and inflation were new issues, Keynes made his ideas directly influence the formation and direction of public policy.

“The study of economics does not seem to require any specialized gift of an exceptionally higher order. Is it, not a very easy discipline compared to the higher branches of philosophy or pure science? An easy discipline that very few excel at! The paradox may be explained by the fact that the expert economist must possess a rare combination of gifts. He must be to some extent a mathematician, historian, statesman, and philosopher. He must understand the symbols and speak in words. He must contemplate the particular from the perspective of the general and consider the abstract and the concrete in the same reasoning. He must study the present thinking about the future. No aspect of the nature of man or his institutions should be left out of his consideration. He must be simultaneously determined and selfless;

This is what Keynes thought about being an economist.

JOHN MAYNARD KEYNES

John Maynard Keynes was born on June 5, 1883, at 6 Harvey Road, in a Victorian-style house on a street in Cambridge, England. He was of affectionate parents, who possessed an intellectual imminence and personal distinction.

His father John Neville Keynes was a young Cambridge professor with a rising reputation as a professor of logic, political economy, and administrator. Her mother Florence Ada, possessed tact and sagacity that allowed her to always be a constant support for her son. He had two siblings, Marguerite, who was born on February 4, 1885, and Geoffrey, who was born on March 25, 1887. They were a family of solid comfort. Maynard Keynes was survived by all of his family.

Seven months after Maynard’s birth, his father Neville Keynes published the first edition of his book Formal Logic, it is a thorough, lucid, and authoritative book. John Neville Keynes, in addition to being a logician, was an economist. he was a good friend of Alfred Marshall and they kept in constant communication using letters.

In June 1891, the University of Cambridge awarded him a doctorate in science, Maynard attended the ceremony, for him his father was a very important person, a solid pillar in his life.

Maynard received his education at Eton, at the age of 14 he entered that prestigious school which maintained links with Cambridge. As he was the oldest and his complexion became more robust, he soon became the leader of a group of boys, advocating for them when necessary, among others he seemed like a little man and became a spokesperson. He excelled in mathematics, history, and the classics and always tried to seek excellence and it was like that throughout his life.

Friendship was very important to him since he almost always tried to stay surrounded by his friends who were characterized by being distinguished and intelligent. He was a member of a prestigious group of English intellectuals called Bloomsbury whose members were: Leonard and Virginia Woolf, Duncan Grant (Keynes’ traveling companion and inseparable friend) Clive and Vanessa Bell, and a very good friend of Keynes Lytton Strachey, the group was interested in philosophy, social conventions, art, literature, music, theater and ballet (a taste inherited from Neville Keynes to his son).

With great intellectual capacity for any career Keynes was oriented towards economics, he was a student at Cambridge of Alfred Marshall who influenced him, 1906 he passed the exam and went to work at the office of India, tired of his administrative tasks he dedicated a large part of from his time to the study of probabilities, thus giving birth to his first book called Treatise on Probability which went on sale in 1921 and was praised. In 1911 Keynes became co-editor of the Economic Journal which he retained until 1945. In 1913 he published a book on international finance relating to the gold exchange standard entitled, Indian Currency and Finance, and from there he became interested and an expert in monetary matters. In 1915 he joined the Treasury Department which he represented in the Versailles treaties. In 1919 he attacked the conditions of the Versailles treaty and wrote a polemical work about the treaty and those who were in it, entitled The Economic Consequences of the Peace, in which he called for consideration for defeated Germany and made considerable criticism of society. North American. He was a teacher at King’s College, he also came to play on the stock market, from which he made a fortune of half a million pounds in 1937, speculating on currencies, being bullish on the dollar, and despising European currencies.

In 1923, he published his Tract on Monetary Reform which deals with the domestic money stock and against the gold standard since it had returned to the old exchange standard. By 1925 he married Lydia Lopokova who was a Diaghilev ballet dancer.

By the late 1930s, the two volumes of the Treatise on Money appeared. This book talked about the important role that savings and investment play in influencing the level of income. He also wrote on other subjects and edited books such as Essays in Persuasion (1931) and Essays in Biography (1933). In 1940 he published “How to pay for the war” since he was interested in the financial burdens imposed on Germany, the rearrangement of resources, and the excess demand with what was seen in the war. In 1946, he was appointed vice president of the World Bank and contributed to the arrangements for the Marshall Loan to Great Britain. At the Bretton Woods conference, he together with Harry Dexter White gave the plans to restore the international monetary system.

After leading a life full of movement, his heart couldn’t take it anymore and he passed away at the age of 63.

GENERAL THEORY OF OCCUPATION, INTEREST, AND MONEY

This book was written in a period characterized by depression, since the early 1930s Keynes had been very interested in the unemployment crisis, which had been damaging the US and England. Keynes’s advice was to make vigorous use of fiscal policy (government tax and spending policy) to complete the private sector market mechanism, which in Keynes’s view was failing to solve the occupation problem.

Part I. Keynes and the Classics

To begin with the development of the general theory, it should be noted that Keynes does not accept the classics and criticizes them too much, he defined the classical tradition as comprehensive not only of Ricardo and his direct disciples but also of John Stuart Mill, Marshall, and Pigou. He said that classism was unacceptable to him. Classical political economy dealt with the distribution of the social product rather than its amount, classism tried to explain the determinants of the relative participation in the national income of the various factors of production and not the forces that determine the level of said income, which can also be called the level of occupation or general economic activity.

The implicit assumption of the classical system, which is made explicit in the market law formulated by James Mill, Say and to a certain extent Ricardo, is that the economic system spontaneously tends to produce full use of the resources available to you. The classics ignored the problem of crises, nor did they specifically analyze the possibility of different levels of economic activity with the same amount of resources.

He does not accept Say’s law, since for him, the balance between saving and investment was not as simple as it was for the classics. Saving and investment were determined by a multitude of factors in addition to the interest rate, and there was no guarantee that the two would be equal at a level of economic activity that produced full employment. He shows that the law of the market, like much of post-Ricardian economics, stopped the classical momentum rather than pushed it forward. Keynes is concerned with aggregates such as income, consumption, saving, and investment rather than with the determination of individual prices which forms the main part of economic theory.

Then we enter into another problem such as employment. Keynes inverted the classic proposition: employment does not increase by reducing real wages, but real wages decrease because of the increase in employment resulting from an increase in aggregate demand.

PART II. AGGREGATE DEMAND AND SUPPLY

As we are going to see in this work, Keynes was based only on showing the short-term effects, and for that, there are three conditions:

- The price level is predetermined (rigid)

- The interest rate balances the supply and demand for money.

- Production is responsible for variations in aggregate demand.

They are one of the determinants of the model to observe short-term economic fluctuations, the aggregate demand curve indicates the quantity demanded of all goods and services in the economy at any given price level, the curve has a negative slope, which means All other things being equal, a fall in the general level of prices tends to raise the quantity of goods and services demanded. The main characteristic is the total consumption of private goods and services, this is the consumption function, which relates the consumption of all private goods and services with the aggregate level of income. Total aggregate demand equals consumption spending plus investment spending. It has a negative slope for three reasons:

- A fall in the price level raises the real value of household money trends which stimulates consumer spending.

- Reduces the amount of money demanded by households, when they try to convert money into interest-bearing assets, interest rates fall, which stimulates investment spending.

- When a fall in the price level reduces interest rates, the domestic currency depreciates in the foreign exchange market, which stimulates net exports.

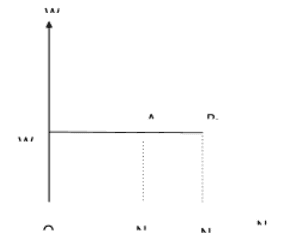

GRAPH 1. SHORT-TERM AGGREGATE SUPPLY (SOURCE: PRINCIPLES OF ECONOMICS)

Short-Term Aggregate Supply

Keynes defined the aggregate supply function as the aggregate supply price of the products corresponding to the employment of a certain number of employees. This graph comes to have the shape of a 45º line, the demand for the goods at given prices is equal. to the supply of goods. A part of the total aggregate demand for goods comprised the demand for investment (plant, equipment, etc.) and Keynes believed that a large mass of these expenditures, at least in the short run, can be regarded as autonomous or independent of the level of income. , the assumption may be perfectly reasonable given that large businesses make long-term investment commitments that take place in the short term regardless of income conditions.

GRAPH. 2 SHORT-TERM SUPPLY-DEMAND CURVE

Short-Term Supply and Demand

The aggregate supply curve indicates the number of goods and services that firms produce and sell at any given price level, the relationship between the price level and the quantity supplied depends on the time horizon. In the short run, the aggregate supply curve has a positive slope due to three possible theories:

- According to the new classical theory of misperceptions, an unexpected drop in the price level leads suppliers to mistakenly believe

- that their relative prices have fallen, which leads to a reduction in production.

- According to the Keynesian theory of sticky wages, an unexpected fall in the price level temporarily raises real wages, which induces firms to reduce employment and output.

- According to the Keynesian theory of sticky prices, an unexpected fall in the price level causes firms to have temporarily very high prices, which induces them to reduce production and sales.

The intersection of aggregate demand and aggregate supply functions determines the equilibrium level of income. If income is higher, aggregate supply will be higher than aggregate demand. The important point of this is that a level of production generated by consumption and investment, although stable, is not necessarily a level of the national product corresponding to that of full employment. Keynes concluded that an economy could have an equilibrium level of income that was less than full employment.

PART III. ROLE OF INVESTMENT

There are two sources of private spending: consumption and investment, of the two Keynes I consider investment spending, by far the most volatile, investment demand is determined by a multitude of factors in addition to the interest rate including future returns expected. The marginal efficiency of capital (real investment) relates the investment cost of capital to the expected returns over the life of investment projects. Keynes considered that expectations that depend on psychological factors have direct and important effects on investment and therefore on income.

The relevant point is, of course, that the change in income (DY) will be greater than the initial change in investment (DI).

The multiplier effect is theoretically predictable because it depends on the numerical value of the marginal propensity to consume. The dependency is easily explained. The initial injection of investment (DI) is received in the form of income by the recipients of factor remuneration, this means that income increases in (DI). These recipients have marginal propensities to consume and to save. which of course adds up to more than one.

Thus the capricious condition of private investment, coupled with the effects of its multiplier on income, meant that the prediction of aggregate income was complex and difficult. But although the levels would be full employment levels only by chance.

PART IV. THE LIQUIDITY TRAP

Keynes suggests that liquidity preferences can be sated in severe depression when declining income has reduced the demand for money for transaction purposes and precautionary monetary policy has already increased the money supply. The liquidity preference curve becomes infinitely elastic due to the unanimous expectation of investors that the interest rate cannot go any lower; bond prices are so high that no one expects them to rise further, consequently, everyone prefers to hoard idle money and monetary policy stops working, it is not necessary to assume that the liquidity preference curve is completely vertical. The “liquidity trap” may take the form of a very low-interest elasticity of the LM curve, open market purchases of government bonds by the monetary authorities may push the interest rate down, but the effect is so slight that perhaps all bonds in private hands must be absorbed for cash before full employment income level is reached. Unless the monetary authorities are willing to become the sole holders of debt and therefore the sole lenders of the economy, a possibility that directly contradicts the logic of monetary policy, which is to influence aggregate demand with a minimum of state intervention, a policy of easy money will not be able to induce recovery.

The LS function shows the demand, by society, for money for speculative purposes; society is presented with the alternative between holding bonds or holding money. Keynes theorized that at high-interest rates (meaning low bond prices, since there is an inverse relationship) individuals would prefer to hold bonds. Bonds are commonly a good deal at high-interest rates, however as bond prices rise and bond buying becomes less and less attractive to sell bonds due to rising bond prices (capital gains), Thus individuals would prefer to keep more and more of their assets in the form of money (and less in the form of bonds), as the interest rate decreases, a similar function is presented in the LS graph.

The liquidity preference function has a typically Keynesian feature, the liquidity trap, he had argued that the interest rate could fall so low (and the price of bonds so high) as to make everyone believe that bonds it was a bad investment, in short, everyone would want to keep the most liquid asset, money. Increasing the nominal money stock will lower the interest rate, but a further increase will not affect the interest rate.

GRAPH 3 LIQUIDITY TRAP (SOURCE: HISTORY OF ECONOMIC THEORY AND ITS METHOD)

Liquidity Trap

Keynes believed that prices were too downwardly inflexible, and rigidities in the economy prevented the price level from falling even in the case of declining aggregate demand in the economy, Keynes believed that declining prices and an additional set of circumstances could improve the situation or what is better known as the Keynes effect.

PART V. BALANCE WITH UNEMPLOYMENT

Keynes wondered if it was possible to be in equilibrium with unemployment, the possibility that in a competitive economy, no mechanism guarantees full employment. Keynes tested the possibility of competitive equilibrium with unemployment by assuming that money wages are downward sticky. He tried to deny that lowering wages was feasible to increase effective demand, and he endeavored to try to prove that lowering wages is not a remedy against unemployment. Unemployment, Keynes argued, could only be effectively attacked through the manipulation of aggregate demand.

Keynes believed that workers suffered from the “monetary illusion”, that is, that their behavior was related to the money wage (W), rather than the real wage (W/P), they refused to accept reductions in their money wages, but would agree to reduce their real wages.

Labor would be supplied in an amount X at the money wage Y but the demand could be such that the real wage would demand only a smaller amount Xo, the result being what Keynes called involuntary unemployment ., the worker would be involuntarily unemployed but with all this the market would be in equilibrium in the sense that no automatic trend could be expected to modify the level of employment Xo. Therefore, a single level of production of full employment could not be assumed, the equilibrium of the economy could be reached with any level of labor utilization. The workers would not accept a reduction in the monetary wage, thus reducing the real wage rate to increase employment, and second, even if they did, prices would probably decrease in the same proportion, causing the displacement of the labor demand function. to the left and keeping the level of unemployment unchanged.

Workers would be willing to accept price increases resulting from increased demand, given stable money wage rates. Such arguments would reduce real wages thus stimulating employment.

But if wage reductions are possible, and if we rule out extreme values of the elasticities of the LM and IS curves as improbable, there will always be some reduction in wages and prices that stimulates consumption by increasing the liquidity of the economy as necessary to satiate the interest rate, thus reaching equilibrium with full employment, but we can say that it is a contradiction to speak that there can be equilibrium with unemployment. However, Keynes argued that prices may not remain constant in the face of falling money wages, because falling wage incomes mean that the demand for goods and the prices of these goods fall. However, lower prices mean that real wages might not decrease and employment would probably not increase,

GRAPH 4. KEYNESIAN LABOR MARKET (SOURCE: HISTORY OF ECONOMIC THEORY AND ITS METHOD)

Keynesian Labor Market

PART VI. SHORT-TERM ECONOMIC FLUCTUATIONS

Economists analyze short-term economic fluctuations using the aggregate demand and supply model, according to this model the production of goods and services and the general level of prices adjust to balance aggregate demand and supply.

When he developed his theory of short-term economic fluctuations, Keynes proposed the liquidity preference theory to explain the determinants of the interest rate. According to this theory, the interest rate is the one that balances the supply and demand of money.

A rise in the price level raises the demand for money and raises the interest rate that equilibrates the money market, as the interest rate represents the cost of borrowing, its rise reduces investment and, therefore, the quantity demanded of goods and services.

In the short term, the price level remains constant, at a level set in the past, given this fixed price level the interest rate adjusts to satisfy the LM equation (monetary liquidity), and given this interest rate the level of production is adjusted to satisfy the IS (investment and savings) equation.

The rigidities of the economy such as monopolies and unions, as they hinder the smooth movement of wages and prices.

According to the Keynesian theory of wage stickiness, an unexpected fall in the price level temporarily raises real wages, which induces firms to reduce employment and output; According to the Keynesian theory of sticky prices, an unexpected fall in the price level causes firms to temporarily set their prices too high, which induces firms to reduce their sales and production.

BIBLIOGRAPHY

- History of economic theory and Its Method

Chapter 19.

Publisher: McGraw Hill

- p. 543-564

- principles of economics

Author: N.Gregory Mankiw

Publisher: McGraw Hill

Chapters 31 and 32

- p. 620,621, 624, 627,628, 635, 658,659.

- Economic theory in retrospect

Author: Mark Blaug

Publisher: Economic Culture Fund

Chapter 15

- p. 786,787,790,791.

- History of economic doctrines

Author: Eric Roll

Publisher: Economic Culture Fund

Chapter 10.

- p. 437,438,439,440,441.

- The Life of John Maynard Keynes

Author: R.F. Harrrod

Publisher: Economic Culture Fund

GLOSSARY

AGGREGATE DEMAND CURVE.- Curve that shows the number of goods and services that households, companies, and the State want to buy at any price level.

AGGREGATE SUPPLY CURVE.- Curve that shows the number of goods and services that companies decide to produce and sell at any price level.

KEYNES EFFECT .- A fall in the price level reduces the interest rate, and promotes the spending of investment goods; therefore raises the number of goods and services demanded.

AGGREGATE SUPPLY AND DEMAND MODEL.- Model used by economists to study short-term economic fluctuations in economic activity around its long-term trend.

PRICE RIGIDITY.- As not all prices adjust immediately to changes in the situation, an unforeseen drop in the price level causes some companies to have higher prices than desired, which induces companies to reduce the number of goods and services they produce.

RIGID WAGES.- As wages do not immediately adjust to the price level, a reduction in the price level makes employment and production less profitable, which induces firms to reduce the quantity of goods and services supplied.

LIQUIDITY PREFERENCE THEORY.- Keynes’s theory according to which the interest rate is adjusted to balance the supply and demand of money. He proposed this theory to explain the factors that determine the interest rate in the economy, it is essentially a mere application of supply and demand.

CONCLUSION

As seen in this study, the contributions of Maynard Keynes are many and very important, which are still valid today, he gives too much importance to the interest rate, money, and employment and if we see it from there they are aspects very basic in the economy.

With him, he returned to macroeconomic problems, where state intervention in the economy was questioned, and with Keynes new issues such as inflation, devaluation, and others were discussed. A very important point that the deal was that he analyzed in the short term since he believed that it was the best because he was living the moment as he said, for the long term we will already have died. He advocated that fiscal policy and economic policy adopt measures to influence aggregate demand.

It must be remembered that Keynes lived in a difficult moment for the world economy since he suffered the depression of the 30s and the two world wars.

His life was very interesting and very active, but his economic activity was simply the best.

However, the inheritance that he left us of his economic contributions is very valuable.

which says “I imagine the typical American would like the European nations to approach him with pathetic glints in their eyes and money in their hands saying: America owes you our freedom and our lives; we bring you what we can with all our gratitude, money not taken by cruel taxes from widows and orphans but saved by us these are the best fruits of victory besides the abolition of armaments, militarism, empire and security internal work that was possible with the help you gave us at such a good time. Then the North American would respond: “I admire your integrity, it was what I expected of you. But I didn’t go to war to make a profit or to invest my money well. The words you have just spoken are enough retribution for me. I forgive you your debts, Return to your homelands and use the resources that I empower you to raise the poor and the unfortunate. And an essential part of this little scene would be the complete and overwhelming surprise with which such words would be received. Oh evil world, it is not in international business where we can find the sentimental satisfaction that we all love. Because only individuals are good and all nations are dishonest, cruel, and cunning.”

As a complement to the study of Keynes’ economic thought, we suggest the following video in which the ideas that make up the Keynesian model are presented.